Infrastructure-Agnostic & Community-Centric: Smart City IoT is Evolving

Based on over two decades of experience and hundreds of smart city and IoT projects, we’ve learned that cities often need more than technology; they need guidance. At Flashnet, we see ourselves as both a technology provider and a partner helping cities navigate standards, architectures and long-term choices. This article summarizes some of those lessons and the principles that can help cities move from pilots to real, scalable impact.

Many smart cities are still experimenting. But some have grown to become efficient, synergistic operating environments. From adaptive street lighting to environmental sensing and public safety, Internet of Things (IoT) projects have matured from pilots into platforms. As we enter the next phase, success will depend on two principles: putting communities at the center and staying infrastructure-agnostic along the way.

In the rapidly advancing landscape of smart city innovation, a new paradigm is reshaping how municipalities deploy and scale Internet of Things (IoT) solutions. Success is no longer measured by isolated technology pilots, but by the integration of infrastructure-agnostic platforms and the elevation of community needs. This article explores the foundational principles that define the next generation of urban IoT – that not only drive efficiency and resilience but also unlocks new forms of value for cities and citizens. Strategies and technical practices that enable future-ready cities to thrive.

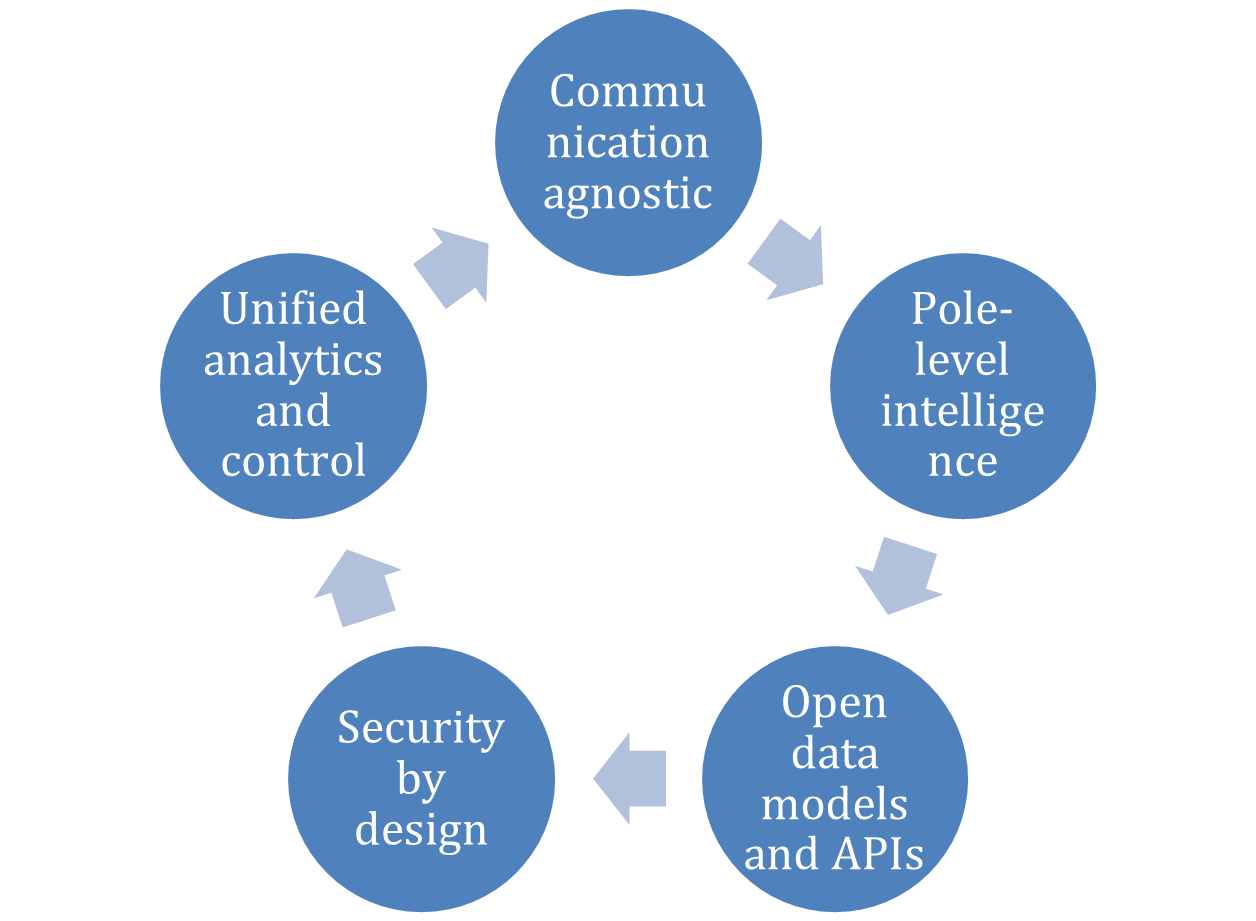

5 steps from point solutions to city-wide platforms

Smart city point solutions are everywhere; the hard part is making them work as one system. Collection routes and roadworks must be timed around rush hours, assets need to be controlled from a single pane, operations and energy consumption optimized, crews coordinated and the whole platform kept safe and reliable for a decade or more.

From recent deployments and industry guidance, five themes are consistently shown to make this achievable: communication agnostic, pole-level intelligence, open data models and APIs, security by design, and unified analytics and control.

Communication agnostic

Why it matters: ability to the most cost-effective, reliable link per neighborhood and use case – without redesigning the system.

What to require: multi-bearer controllers supporting LoRaWAN, NB-IoT/LTE-M, 4G/5G and Wi-Fi/Ethernet backhaul; policy-based link selection (coverage/latency/cost/power); seamless failover (eSIM/dual-SIM where relevant); OTA re-provisioning; an abstraction layer so applications are decoupled from the transport.

Pole-level intelligence

Why it matters: faster responses, lower bandwidth bills and better privacy.

What to require: edge AI, on-device inference for anomaly detection, traffic/pedestrian classification, adaptive lighting and power-quality monitoring; event-driven messaging (send metadata, not raw streams); sub-100 ms local actuation with safe fallback modes; configurable privacy policies (e.g., automatic redaction/edge aggregation).

Open data models and APIs

Why it matters: plug-and-play across vendors and future apps.

What to require: standards-based schemas and APIs (e.g., TALQ for lighting control, OGC SensorThings/OGC API for geo-timeseries), REST/GraphQL + MQTT where suitable, versioned resources, webhooks, and well-documented IDs/metadata so assets are discoverable across systems.

Security by design

Why it matters: street assets are critical infrastructure; security can’t be bolted on.

What to require: secure element/HW root of trust; mTLS with certificate rotation; signed firmware and staged OTA; least-privilege RBAC and audit trails; network segmentation/zero-trust gateways; vulnerability management aligned with recognized frameworks.

Unified analytics and control

Why it matters: one operational view for lighting, traffic, environment, and safety—fewer screens, faster decisions.

What to require: a domain-agnostic platform (digital-twin ready) that unifies inventory, alarms, work orders, and KPIs; real-time + historical analytics; open connectors to CMMS/ITS/SCADA; role-based dashboards and API access for partners.

Bottom line, urban IoT is moving from one-off projects to platform ecosystems. Specify upgradeable devices, insist on multi-bearer connectivity, require open APIs and strong security from day one, and operate through a unified analytics/control layer. That’s how you avoid lock-in, switch networks as conditions change, and share data across applications without re-engineering the stack. But where do you start?

Energy infrastructure owners have an edge

Owners of poles, power and backhaul – whether the city itself or a utility – are best positioned to modernize quickly. Existing assets, crews, and service territories provide a head start – and decades of running critical infrastructure make these organizations the best place to learn, with mature maintenance, safety and outage workflows already in place.

Let’s decrypt next a few lessons from real projects and partner ecosystems – what to standardize, what to pilot, and what to avoid – so that this advantage converts into city-wide outcomes:

- Map your available communications. Inventory LoRaWAN, NB-IoT/LTE-M, 4G/5G, Wi-Fi/Ethernet, fiber, and private networks. Define policy rules (latency, coverage, cost, power) so the “right link for the job” can be selected per zone and switched later without redesign. Keep in mind that redundancy is recommended for critical infrastructure, so also check for backup communications.

- Map desired integration standards. Commit up front to open interfaces: TALQ for lighting control, OGC SensorThings / OGC API for geo–time series, and NGSI-LD/oneM2M-style data models where relevant. Make these non-negotiable in specs and acceptance tests.

- Segment the network by criticality. Safety-critical functions (e.g., intersections) get deterministic connectivity, tighter SLAs, and redundancy; non-critical sensing rides cost-optimized LPWAN with store-and-forward.

- Define added features before acting. Research your community and consider as many services you think you might need in an ideal future: EV-chargers, air quality, parking/occupancy, and fault detection etc. Research vendors, projects and build a database.

- Build a pilot with all stakeholders. Set-up a cross-vendor testbed (utility, hardware, software, maintenance, IT/OT). Make interoperability-first procurement non-negotiable with open APIs, exportable data, standards-aligned models, and the ability to switch connectivity vendors without touching field devices. Prove installation, connection, interoperability and workflow integration before scaling.

- Start with a city-wide upgrade. The ubiquitous pole network of street lighting is usually used as the first measurable anchor. Street lighting has the unique advantage of providing both power and hardware installation opportunities throughout the city. Once lighting is controlled, it’s easy to add functionalities to each pole.

- Aim tenders at multi-supplier ecosystems. Specify outcomes and standards compliance, not a single vendor stack. Require conformance testing, swap-ability of devices, and API-level interoperability. Specify testing requirements during the process.

- Own the data, not necessarily the hardware. Lock in rights for data portability, real-time API access, and historical retention. Value is created in analytics and service integration; contracts should reflect that.

“As a partner for the German market, we value Flashnet’s deep technical expertise and their commitment to open, interoperable smart city solutions. Their team doesn’t just develop products — they understand the broader system architecture and the challenges utilities and municipalities face in real deployments.

Working with Flashnet feels more like exchanging knowledge with a consultant than with a supplier. Their experience and openness to collaboration make them a trusted partner for building scalable, future-ready smart infrastructure,” said Zoltan Horvath, Head of Product Development and Project Management for Digitalization, Energy Efficiency, and Remote Systems at co.met GmbH.

And that’s not all. Municipalities can borrow further best practices from utilities:

- build lifecycle business cases over 10–15 years, capturing full TCO, energy savings, avoided outages, maintenance efficiency and social benefits – rather than optimizing for upfront CAPEX alone

- deploy in phased, KPI-driven increments – think 90-day sprints that prove functionality and de-risk scale-up while demonstrating ROI

- enforce cybersecurity baselines from day one, including certificate management, a formal vulnerability-disclosure process, and regular signed firmware updates

Next, let’s bring numbers to the table: estimated ROI ranges, payback periods, and the operational assumptions behind them.

Estimated ROI from connected cities

Every city starts from a different baseline, but the evidence from public case studies and technical papers points to repeatable ranges. When lifecycle costs and benefits are tracked over 10–15 years, smart cities tend to pay back within one planning cycle. Without considering community benefits.

- For smart street lighting with adaptive controls, energy savings of 50–70% versus legacy HPS are routinely achieved, with an additional 10–20% on top of LED-only through dimming and scheduling. Maintenance OPEX is typically cut by 20–30% via remote monitoring and optimizing maintenance crews dispatch. Across varied tariffs and labor rates, 3–6 years is a realistic payback window.

- For environmental sensing (air quality, noise, microclimate), there’s not much direct energy savings, but ROI is created through regulatory compliance, targeted interventions and public-health co-benefits. Value is realized as avoided penalties, optimized traffic schemes and improved eligibility for grants. When analytics drive policy and enforcement, 3–7 years is a common payback range.

- For safety and incident detection (crosswalks, tunnels, parks), benefits accrue through reduced incidents, faster response, and insurance savings. In areas with moderate to high incident rates, 2–5 years payback is achievable; in lower-incident areas, pilots are used to validate assumptions before scaling.

ROI accelerates markedly when multiple services are bundled onto existing lighting infrastructure, when performance-based contracts align outcomes and risk, when networks are reused across departments, and when open data products enable third-party value (planning, mobility, research). With these levers in place, cities can move from isolated wins to platform economics, turning conservative ranges into dependable returns.

In the end, start with the community

It’s easy to get swept up by “smart” features and distant roadmaps. Better try to avoid putting technology first though. Start with what residents and local businesses actually need and keep that north star visible throughout delivery. Re-check plans against the original community outcomes at every milestone; run quick qualitative checks so technology serves the city, not the other way around.

Technology only succeeds when people feel the benefits and trust the system.

- Deliver visible wins early. Safer, better-lit streets that adapt to real activity levels build support faster than fancy presentations.

- Design for accessibility. Publish open dashboards and citizen-facing apps, not just internal reports.

- Practice inclusive governance. Bring residents, local businesses, and vulnerable groups into pilots and feedback loops; share data and results openly.

At FLASHNET, we’ve been dedicated to interoperability and community-centric solutions for over two decades. Our urban IoT solutions are infrastructure-agnostic by design, combining interoperable devices, open data models/APIs, and security-first operations to deliver citizen value and ROI that compounds as new services come online.

About FLASHNET

FLASHNET is a fast-paced tech company that integrates the latest IT, energy and telecommunications technologies into hardware and software solutions, creating and implementing intelligent systems for smarter cities and better infrastructure. Founded in 2005, FLASHNET is a leader in intelligent utility management systems, with worldwide operations. (www.flashnet.ro)

About inteliLIGHT ®

inteliLIGHT® is a smart street lighting control solution that offers detailed lamp-level management capabilities (ON/OFF, dimming, real-time reporting) over multiple IoT communication technologies. In-depth grid awareness is obtained through accurate utility-grade readings of any changes occurring along the grid, reducing energy loss and offering advanced maintenance optimization tools. Furthermore, inteliLIGHT® is integrated with Smart City management platforms and offers support for further Smart City development. (www.inteliLIGHT.eu)

About Lucy Group

Lucy Group is a diversified international group with operating businesses across three sectors: Lucy Electric, Lucy Controls and Lucy Real Estate. Since its origins in Oxford, over 200 years ago, the Group has grown and evolved. Lucy Group now employs over 1,500 employees across offices and factories in 10 regions and trades in over 70 countries. The Group’s annual revenues in 2021 were over £250 million. Further information can be found at www.lucygroup.com